State-Supported (§4201) Schools

STAC, within the NYS Education Department's STAC and Medicaid Unit, is responsible for processing requests for Commissioner's approval for reimbursement. This includes reimbursement approvals for the costs of students attending specially designated schools, listed in §4201 of the New York State Education Law, for children with deafness, visual impairment, emotional disturbance or multiple disabilities.

List of §4201 State-Supported Schools

- Cleary School for the Deaf

- Lexington School for the Deaf

- New York School for the Deaf (Fanwood)

- The Henry Viscardi School

- Mill Neck Manor School for the Deaf

- Rochester School for the Deaf

- Lavelle School for the Blind

- The New York Institute for Special Education (NYISE)

- St. Francis de Sales School for the Deaf

- St. Joseph School for the Deaf

- St. Mary's School for the Deaf

Request for Reimbursement Approval

The STAC Unit will confirm that a valid Commissioner’s Appointment has been approved by the SEQA Nondistrict Unit (NDU). The approval must be valid for the education and/or residential program placement by the CSPE or CSE.

STAC Unit Acceptance of §4201 Reimbursement Approval Requests

New/Initial NDU Approval Required by STAC Unit:

- Transition from Deaf Infant Program to §4201 Preschool.

- Transfer from one §4201 school to another §4201 school.

- Transfer from a State-operated school to a §4201, and vice versa.

- Change in placement from §4201 day to §4201 residential placement.

- Change in Local Education Agency (LEA), but remaining in §4201 school initially appointed.

LEA to submit signed/dated STAC-1 form to the STAC Unit. No update to existing NDU approval required by STAC Unit:

- Change in placement from §4201 residential to §4201 day placement.

- Change between full-time and part-time §4201 placement.

- Transition from preschool age to school age placement at same §4201 school.

Contact the NDU for assistance with the PHC-10 Evaluation Application or §4201 Appointment Application. Applications for Commissioner’s Appointment need to include separate STAC-1 forms for the 2-month and 10-month placements.

| Nondistrict Unit: | Applications: |

|---|---|

Office of Special Education Email: StateSup4201@nysed.gov (4201 schools) |

Frequently Used

Special Education Applications (See section "Commissioner's Appointments") |

Terms and Definitions

District of Residence

The District of Residence is the school district in which the student's parents or legal guardians currently reside. Whenever the student's parents relocate to a different school district, the District of Residence changes. For Chapter Placements, it is the school district in which the child resides.

Basic Contribution

The Basic Contribution is defined in Subdivision 8 of §4401 of the Education Law as an amount equal to the total base year property and non-property taxes of the school district divided by the base year public school enrollment of the district. Any revenues received from the State under the School Tax Relief Program (STAR) are considered property taxes for this purpose.

Fiscal Responsibility

The school district of residence is fiscally responsible for §4201 program placements at State-supported schools for students ages 3 through 21. The county is fiscally responsible for §4410 program placements.§4201 2-Month (Summer) Programs

- The District of Residence receives a 20 percent chargeback for education and maintenance costs.

- The District of Residence claims 80 percent aid for transportation costs using the DVST3 online verification screen in EFRT.

§4201 10-Month (School Year) Programs

- The District of Residence pays education tuition directly to the §4201 school.

- The State will reimburse tuition paid, less the district's Basic Contribution, for the FTE period.

- The district reports transportation costs to State Aid.

- The State pays the §4201 school directly for ten-month school year maintenance (room and board) costs.

Reporting Transportation Cost to NYSED STAC Unit

The STAC Unit processes reimbursement for certain transportation costs based on the type of education program being provided.

School district responsibility for students placed in a §4201 program includes students preschool age (3 – 5) through 21.

- For 10-month transportation costs, reimbursement is not available through the STAC Unit. The responsible school district claims reimbursement for transportation costs through the Transportation Aid process, along with transportation costs for other 10-month students. The Transportation Aid process is not tied to the STAC Online System’s education/maintenance DSSSY placement records, and no 10-month transportation costs for these students are reported to the STAC Unit.

- For 2-month (summer) session transportation costs, the responsible school district may be reimbursed through the STAC summer school claim process (§4408) for special education students. The STAC Online System screen used by school districts to report and verify transportation costs is DVST3. Costs are reported on a child-specific basis. A school district can only submit costs on the DVST3 screen when a corresponding education/maintenance DSSOS placement record has been added to the STAC Online System.

Online Verification of Reimbursement Approvals

For students with 10-month placements at a State-supported §4201 school, districts are entitled to receive 100% reimbursement for the costs of tuition, less their basic contribution. Reimbursement is only available for students whose STAC approvals are verified online prior to the annual December 1st verification deadline.

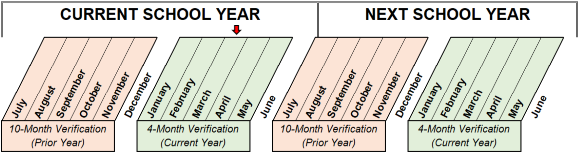

4-Month Verification Period

- January 1 to June 1

- During this timeframe, school districts can verify tuition costs incurred during the first four months (September - December) of the current school year.

10-Month Verification Period

- July 1 to December 1

- During this timeframe, school districts can verify tuition costs incurred during the full 10-month (September - June) period from the prior year.

- School districts must verify records during this period to receive reimbursement, even if a record had previously been verified during the 4-month timeframe. Failure to verify the full 10-month record will result in repayment of any tuition reimbursement received in the first payment for the 4-month (September-December) period.

§4410 Preschool Programs

Mill Neck Manor, Lavelle School for the Blind, and the NY Institute for Special Education offer §4410 preschool programs in addition to their §4201 preschool age programs. Program approval and fiscal responsibility are handled like any other §4410 preschool program.

Deaf Infant Program

SED pays the §4201 school directly for their Deaf Infant Program costs.

Dormitory Authority

The New York State Education Department pays the Dormitory Authority for the debt service costs of the §4201 schools.

STAC Record Processing Timetable

Calendar of required school district and §4201 school submissions.

Resources

- §4201 State-Supported 3- and 4-Year-Old Transportation Memo (HTML) (PDF)

- New Procedure - STAC Online Re-applications for Continuing 10-Month Placement at §4201 State Supported Schools - Effective September 1, 2015

- Students Enrolled in §4201 State-Supported Schools Who Attend a BOCES or School District Program Part Time

- Tuition Payment and Medicaid Billing Responsibility Changes Effective September 1, 2013

- Per Pupil Tuition Rates (Set by NYSED Rate Setting Unit)

2016-2017 2017-2018 2018-2019 2019-2020 2020-2021 2021-2022 2022-2023 2023-2024 Districts can access history of 10-month tuition reimbursement payments on the EFRT DQPAY screen. Archived Per Pupil Tuition Rates - §4201 Minimum Wage Survey

- §4201 Minimum Wage Survey Instructions