DCPUB High Cost Student Worksheet (BOCES/In-District)

Quick Reference

STAC ONLINE SYSTEM (EFRT) SCHOOL AGE PRE-VERIFICATION TOPICS

Printable Version

Guidance for Calculating 10-Month Annualized Costs for In-District Verifications:

A list of allowable costs for special education services which may be claimed for High Cost Aid and a list of other costs

which may not be claimed can be found by clicking on the link below:

https://www.oms.nysed.gov/stac/schoolage/payments/

annualized_cost_calculation.html

To print this screen on one page in Google Chrome:

- Ctrl+P to bring up the Print panel.

- Click the down arrow to the right of "More settings"

(or the plus sign to left, depending on your version of Chrome)

- Enter "57" in the box to the right of “Scale”

Depending on your printer’s default margins, you might need to make the scale number slightly larger or slightly smaller.

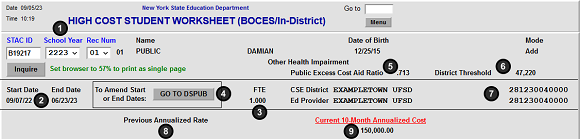

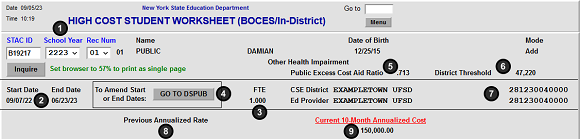

Contains the information entered on the approval on DSPUB.

- STAC ID, School Year, and Rec Num

The student’s STAC ID and the school year and record

number of the DSPUB approval.

- Start Date and End Date

Taken directly from DSPUB. To change, update

on DSPUB.

- FTE

Full Time Equivalent Enrollment, from DSPUB.

- The Go to DSPUB button

This button takes you directly to the associated approval

on DSPUB.

- Public Excess Cost Aid Ratio

Ratio is used in the calculation of Public Excess Cost

Aid.

|

- District Threshold

Your district’s threshold for the selected school year.

- CSE District and Ed Provider

CSE school district and the education provider, taken

directly from DSPUB.

- Previous Annualized Rate

If the 10-Month Annualized Cost has changed, the

previous value is displayed here. This will update

whenever this screen is submitted.

- Current 10-Month Annualized Cost

Before the screen has been submitted,

this is the amount entered on DSPUB.

After the screen has been submitted, this

is the amount calculated by the

worksheet.

|

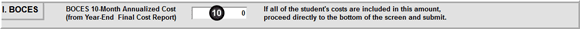

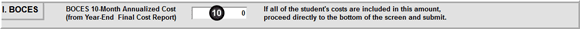

Only to be used if the student is listed on the year-end final cost report from a BOCES.

- BOCES 10-Month Annualized Cost (from Year-End Final Cost Report)

Enter the 10-Month Annualized Cost from the BOCES year-end final cost report. If there were additional BOCES

costs that weren’t included in the year-end final cost report, don’t enter them here; instead, enter them in the

appropriate section below.

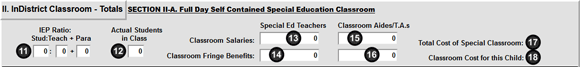

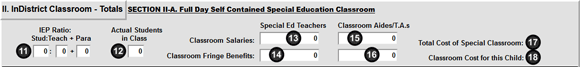

- IEP Ratio: Stud:Teach + Para

Ratio of students to teachers and paraprofessionals of

the student’s primary classroom, per the IEP.

- Actual Students in Class

The number of students that were actually educated in

the class. For partial day students, round up to the

nearest whole number. Cannot exceed the stated

classroom ratio on the IEP.

- Special Ed Teachers – Classroom Salaries

Enter the percentage of the teacher’s salary

directly related to classroom special education

instruction, plus class prep. See note below.*

- Special Ed Teachers – Fringe Benefits

Enter the percentage of the teacher’s salary

directly related to classroom special education

instruction, plus class prep. See note below.*

|

- Classroom Aides/T.A.s – Classroom Salaries

Enter total salaries of classroom aides and T.A.s. If less

than full-day, prorate accordingly. Do not include any

aides assigned to specific students.

- Classroom Aides/T.A.s – Classroom Salaries

Enter total value of the fringe benefits for classroom

aides and T.A.s. If less than full-day, prorate

accordingly. Do not include any aides assigned to

specific students.

- Total Cost of Special Classroom

Total cost for all students in the special education

classroom. A calculated field that does not permit data

entry.

- Classroom Cost for this Student

Total Cost of Special Classroom / Actual Students in

Class. A calculated field that does not permit data entry.

|

| * NOTE: |

Example for 13 and 14: If a teacher has 5 instruction periods, plus 1 class preparation period, plus 1

administrative period per day, you would prorate the salary and fringe at 6/7ths of the total.

Salary: $80,000 x (6/7) = $65,571.43; Fringe: $34,000 x (6/7) = $29,142.86 |

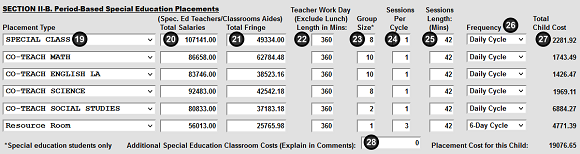

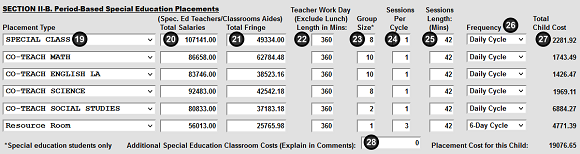

- Placement Type

Ratio of students to teachers and

paraprofessionals of the student’s

primary classroom, per the IEP

- (Spec. Ed Teachers/Classroom Aides) Total Salaries

The combined salaries for the

special education teacher(s) and

classroom aides. Do NOT include

general education teacher salaries

- (Spec. Ed Teachers/Classroom Aides) Total Fringe

The combined cost of fringe benefits

for the special education teacher(s)

and classroom aides. Do NOT

include general education teacher

fringe benefits

- Teacher Work Day

(Exclude Lunch) Length in Mins

The length of the teacher’s work day

in minutes, excluding lunch.

• 6.5 hours = 390 minutes

• 6 hours = 360 minutes

• 5.5 hours = 330 minutes

- Group Size

The number of special education

students in the classroom. Do NOT

count general ed students

|

- Sessions Per Cycle

The number of times the student

attended this class during the cycle

length specified in the frequency

column. Cannot exceed IEP

- Session Length (Mins)

The length of each session, as

specified on the student’s IEP

- Frequency

The length of the cycle specified on

the student’s IEP. The Sessions Per

Cycle repeats on this interval:

• Daily Cycle

• 4-Day Cycle

• Weekly Cycle

• 6-Day Cycle

- Total Child Cost

The cost of the placement, as

calculated

from the information provided. This

calculated field does not permit

data entry

- Additional Special Education Classroom Costs (Explain in Comments)

If the student has more than six special classes, enter the cost of the remaining special classes as a lump sum.

|

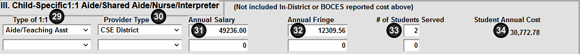

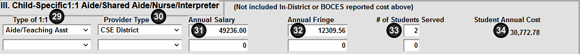

Only to be used for aides, LPNs, RNs and interpreters assigned to specific students.

- Type of 1:1

Indicate type: Aide, LPN, RN, or Interpreter.

- Provider Type

Indicate type: Non-Resident District, CSE District,

BOCES, or Other Provider

- Annual Salary

Enter salary. If the person is assigned for only part of the

day, prorate by number of hours assigned to this

student. Annualize if student’s FTE is less than 1.

- Annual Fringe

Enter value of fringe benefits. If the person is assigned for

only part of the day, prorate by number of hours assigned

to this student. Annualize if student’s FTE is less than 1.

|

- # of Students Served

Enter the number of students assigned during the time

period covered by IEP. If assigned solely to this student

(1:1), enter 1 in this field.

- Student Annual Cost

Student Annual Cost = (Annual Salary + Annual Fringe) /

# of Students Served. A calculated field that does not

permit data entry.

|

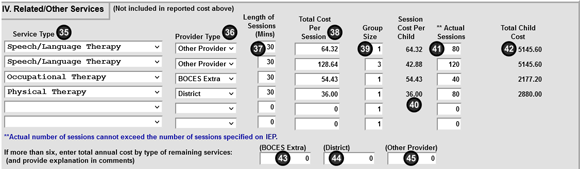

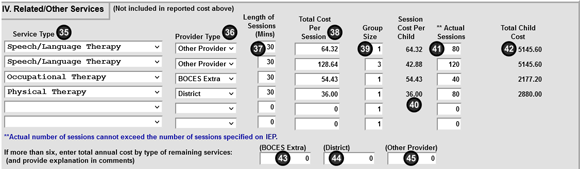

Services entered in this section cannot have been claimed in any of the sections above. You can enter up to six services

in this section, with space to enter lump sum totals by provider type for any additional services.

- Service Type

Select type of service from the dropdown. If the service

is not listed, select "Other -- Explain in Comments".

- Provider Type

Indicate whether service was provided by a school

district, a BOCES, or some other provider.

- Length of Sessions (Mins)

Enter number of minutes per session for service.

Should not exceed IEP.

- Total Cost Per Session

Enter total cost per session for service for all students.

- Group Size

Select number of students receiving service. For

individual services, use 1 as the group size.

- Session Cost Per Child

Total Cost Per Session / Group Size. A calculated field

that does not permit data entry.

|

- Actual Sessions

Actual number of sessions student received for service.

Cannot exceed the IEP.

- Total Child Cost

Total cost attributable to student. A calculated field that

does not permit data entry.

- BOCES Extra

If more than six related services, calculate and enter

total cost of any additional services provided by

BOCES not included above. Explain in comments.

- District

If more than six related services, calculate and enter

total cost of any additional services provided by

district not included above. Explain in comments.

- Other Provider

If more than six related services, enter total cost of

any additional services provided by an outside

provider. Explain in comments.

|

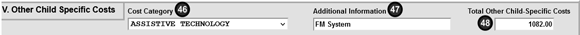

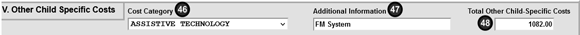

Only to be used for non-recurring costs not claimed in sections I through IV.

- Cost Category

Select type of cost from dropdown. If not listed, or if

more than one cost, select “OTHER -- Explain in

Comments”.

- Additional Information

Provide additional detail on cost.

|

- Total Other Child-Specific Costs

Enter total amount of all non-recurring costs. Since this

section is for non-recurring costs, this amount should

not be annualized.

|

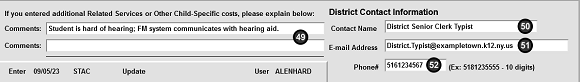

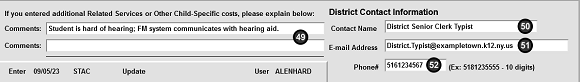

To be used to provide additional clarification and explanation, and to provide contact information in case there are

questions.

- Comments

Use to provide explanations for anything that is unclear

from the standardized fields above.

- Contact Name

Name of the person who can answer questions about

this High Cost Student Worksheet (DCPUB) submission

for the STAC and Medicaid Unit.

|

- E-mail Address

E-mail address for the person indicated in Contact Name

field.

- Phone#

Phone number for the person indicated in Contact Name

field.

|

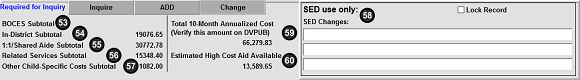

Once you have completed all of the sections, click the ADD button to submit. If updating an existing DCPUB worksheet,

click Change to submit your changes.

Will populate once screen has been submitted. All calculated fields that do not permit data entry.

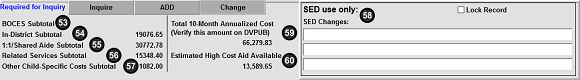

- BOCES Subtotal

BOCES 10-Month Annualized Cost (from Year-End

Final Cost Report) field in section I.

- In-District Subtotal

Calculated Classroom Cost for this Student from section II.

- 1:1/Shared Aide Subtotal

Sum of the two calculated Student Annual Cost values

from the section III.

- Related Services Subtotal

Sum of the calculated Total Child Cost values for 6

services, plus 3 lump sum fields, from section IV.

- Other Child-Specific Costs Subtotal

Total Other Child-Specific Costs from section V.

- “SED use only” Section

Used by SED staff to note adjustments resulting from review.

|

- Total 10-Month Annualized Cost

Sum of the five subtotals on left. A calculated value that

will update both DSPUB and DVPUB. Verify this amount

on DVPUB.

- High Cost Aid Available

An estimate of the Public High Cost Aid your district

would receive for this record, based on current district

threshold and public excess cost aid ratio.

Calculated as follows:

|

| |

Total 10-Month Annualized Cost |

$66,279.83 |

| - |

District Threshold |

$47,220 |

| |

Annualized Excess Cost |

$19,059.83 |

| x |

FTE |

1.000 |

| |

Aidable Excess Cost |

$19,059.83 |

| x |

Public Excess Cost Aid Ratio |

0.713 |

| |

Estimated High Cost Aid Available |

$13,589.65 |

|

To be used to provide additional clarification and explanation, and to provide contact information in case there are

questions.

To be used to provide additional clarification and explanation, and to provide contact information in case there are

questions.

Will populate once screen has been submitted. All calculated fields that do not permit data entry.

Will populate once screen has been submitted. All calculated fields that do not permit data entry.